Consolidation vs. Refinancing Student Loans

If you have multiple student loans and would like to make life simpler by managing fewer loans, you may want to consolidate them. Or do you want to refinance them? Like many people, you may be stumped at the difference between consolidating and refinancing, and confused about which option is ultimately best for you.

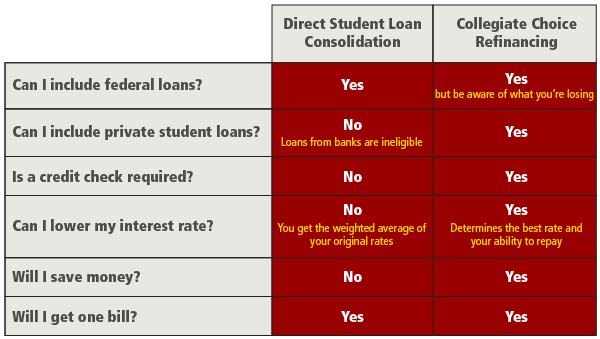

Let’s start with clearing up a fundamental question we hear often: “Is refinancing a student loan the same as consolidating a student loan?” The answer is no. While consolidations and refinancing can reduce the number of loans you have to manage, they are not the same thing. Knowing the difference between the two options is very important as you make the decision about which path to take.

Student loan refinancing allows you to combine all of your educational loans, both federal and private, into one loan with one rate and one lender to repay. The benefit of refinancing outside of having one loan, one rate, and one lender is that you may also save a significant amount of money as a result of potentially lower interest rate. The downside to refinancing is that you will lose any benefits you may have had with the your federal loans, such as access to federal debt relief programs (income-based repayment, public service forgiveness, etc.).

Consolidation is a U.S. Department of Education program that allows you to combine your federal education loans into one single loan. The benefit of a direct consolidation loan is that it allows you to keep your federal and private student loans separate and retain all of your federal loan benefits. The downside to consolidation, especially if you are trying to minimize student loan providers, is that at a minimum you will pay two loan servicers: the one servicing your consolidation loan and the one servicing your private loan. Also, because the interest rate is not reduced in a consolidation, you won’t save any money.

Before you make your decision, consider this: refinancing student loans is not for everyone. Refinancing is best for those who have shown improvement and stability in employment, income, and credit since graduating from school. Refinancing may not be best for people working in the public sector, or people who are taking advantage of federal debt relief programs such as income-based repayment or public service forgiveness, as access to programs such as these are lost when you include federal loans in a refinance.

In summary, if you are financially stable, have good credit, and would like to bring all of your loans together under one loan with perhaps a lower interest rate, and you do not see the need to preserve your access to federal loan benefits, then refinancing is something you should explore.

If, on the other hand, you are working in the public sector and wish to preserve access to public service loan forgiveness, or think you may need access to debt relief benefits, then a direct consolidation may be your better option.

A USC Credit Union representative can help you determine which option is right for you.

Subscribe

We provide the tools to build a smart financial future. Subscribe now!